Industry costs slow down significantly, CPT Cost Monitor indicates

The fourth report from an independent industry-wide survey of bus industry operating costs shows a significant slowdown in the rate of increase in the 12 months to February 2024. At the same time, analysis of the figures suggests that a 10% increase in bus speeds has the potential to deliver 135 million miles of extra services each year at no extra cost.

The twice-yearly CPT Cost Monitor Report analyses industry costs, examines operating costs per hour and kilometre, and tracks movements over time. It also presents a range of KPIs covering service provision, fleet utilisation, fuel consumption and staff productivity.

“The latest data shows overall gross costs rose by 3.1% in the year to February 2024 in Great Britain outside London” – Keith McNally, Operations Director at the CPT

Commenting on the results, Keith McNally, Operations Director at the Confederation of Passenger Transport, said: “The latest data shows overall gross costs rose by 3.1% in the year to February 2024 in Great Britain outside London. But that translates into a real-term fall of 3.7% after adjustment for inflation to December 2023 prices. This was a marked improvement on the previous two years,” when costs had risen by over 16% above inflation.

The report also highlights how the 7.6% increase in labour costs during the year was a sign that the pressure on costs had not gone away: “Last year, those increases were offset by savings and efficiency improvements elsewhere,” he added, “but we cannot assume that such savings can always be achieved.”

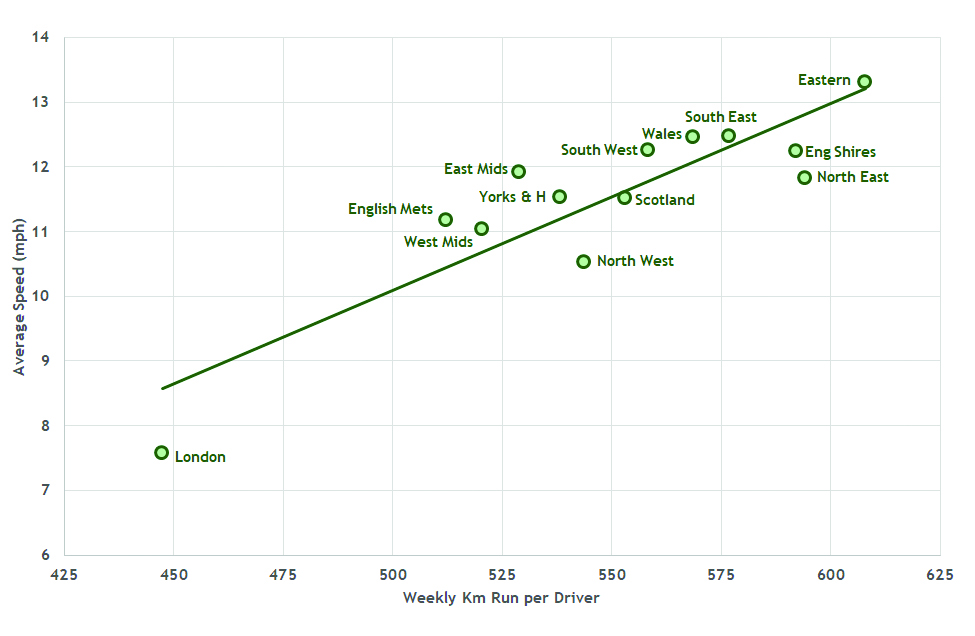

A graph from the latest Cost Monitor showing average bus speed versus driver productivity by region and market segment (February 2024)

The latest report also confirms that bus speeds remain low, averaging just 11.7mph across Great Britain outside London in February 2024 (to allow for passenger boarding/alighting times and because of delays due to traffic conditions). The analysis highlights the close correlation between bus speed and driver productivity (measured in terms of weekly kilometres run per driver).

Speaking about this, Keith McNally said: “If bus speeds could rise by just 10% – through giving buses greater priority on our roads – then every driver could cover an additional 34 miles every week. Given bus operators employ around 84,000 drivers, this alone could enable operators to provide an additional 135 million miles of services each year at no extra cost.

“This improvement could be delivered as extended hours of operation, and more frequent or more weekend services as well as new routes. In some areas, a 10% improvement in average speed would help maintain routes where rising costs and changing revenues threaten to make services unviable.”

About the Cost Monitor

CPT hopes the data provided by Cost Monitor will help inform constructive discussions and negotiations between transport authorities and bus operators about service levels, inflationary increases applied to contract prices, and about how to fund the future services passengers want.

The CPT Cost Monitor was first published in 2022 and is now in its fourth edition. It was developed to replace the previous CPT Cost Index produced for many years before Covid dramatically impacted bus services.

Commissioned from independent consultants (2FM Limited) to preserve strict confidentiality, the Cost Monitor collates data contributed by operators with a peak vehicle requirement of over 21,000 to help ensure it is highly representative.

The full report is provided only to those operators who contributed data. The 49 core companies that have provided data for each update of Cost Monitor since 2022 demonstrate a continuing trend of increased kilometres run (2.3% outside London in the year ending February 2024, continuing the trend of a small recovery observed to June 2023 (0.9%), suggesting service levels have stabilised and are beginning to recover thanks to more BSIP (Bus Service Improvement Plan) funding and a reduced driver shortage. This improvement does not apply however to Scotland or Wales and is not universal across all parts of England, CPT says.

The database is already open for June 2024 data (to feed the next edition of Cost Monitor) and any organisation wishing to contribute should contact [email protected]