Bus and coach market surges in first quarter

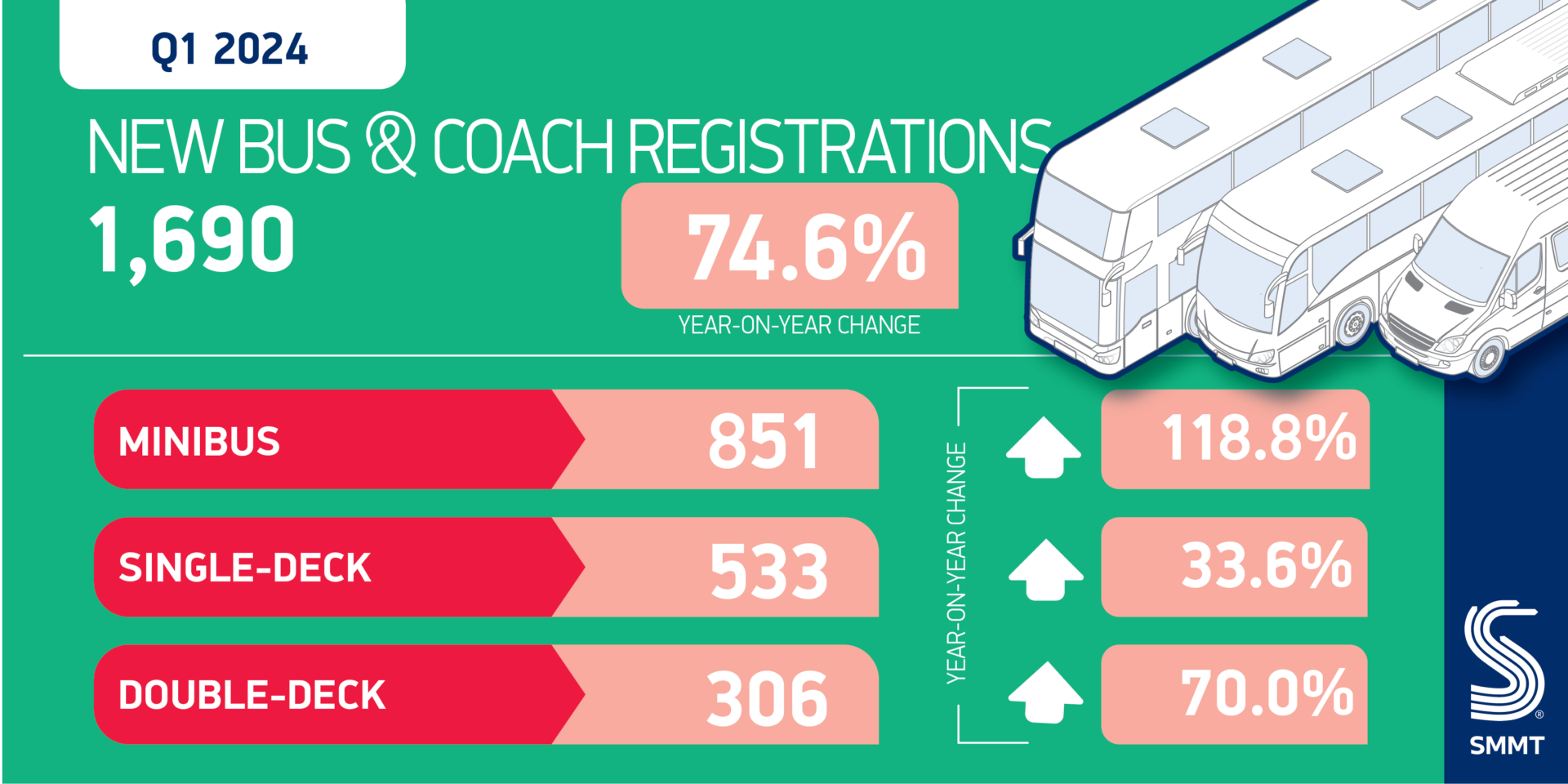

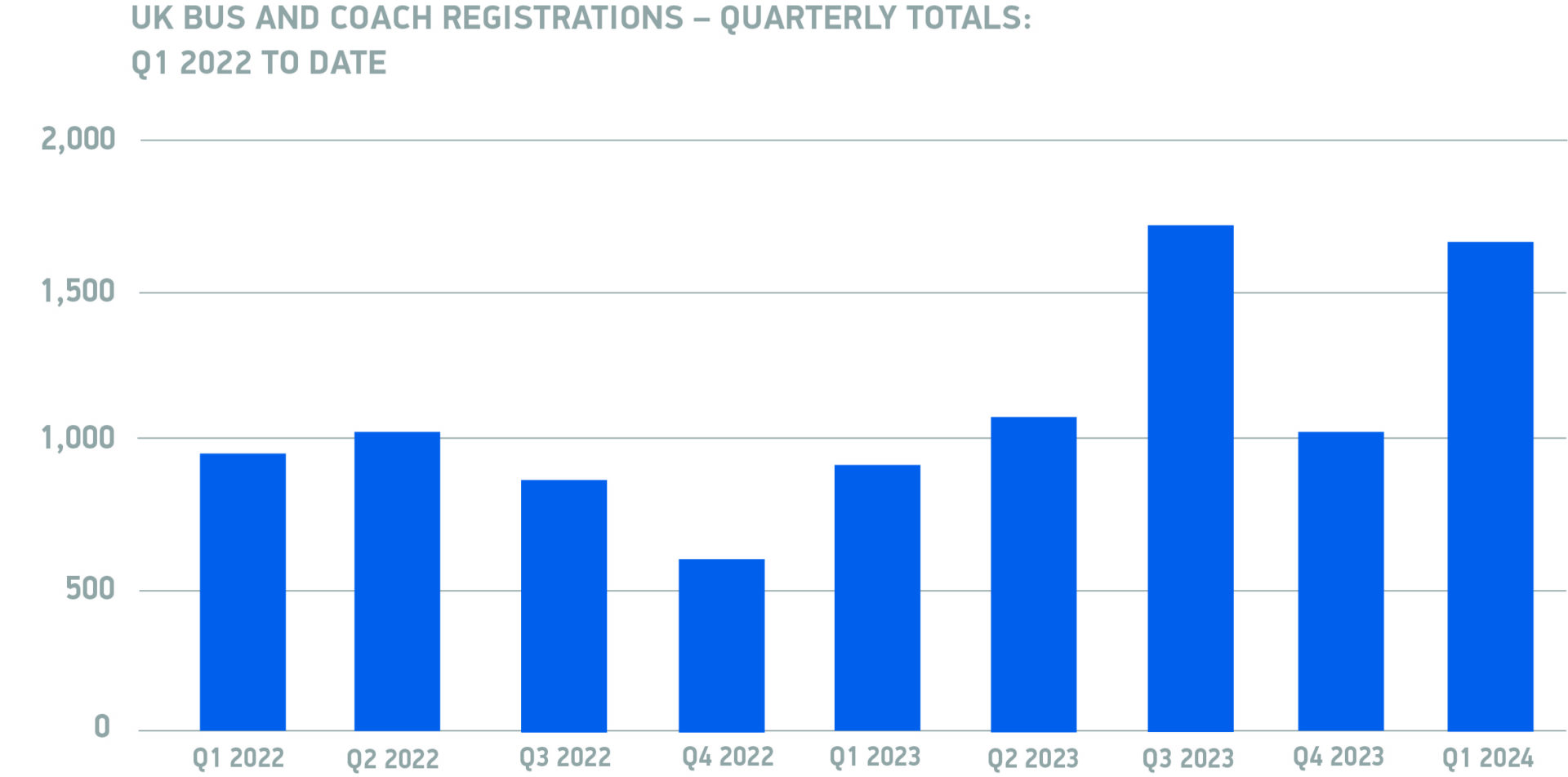

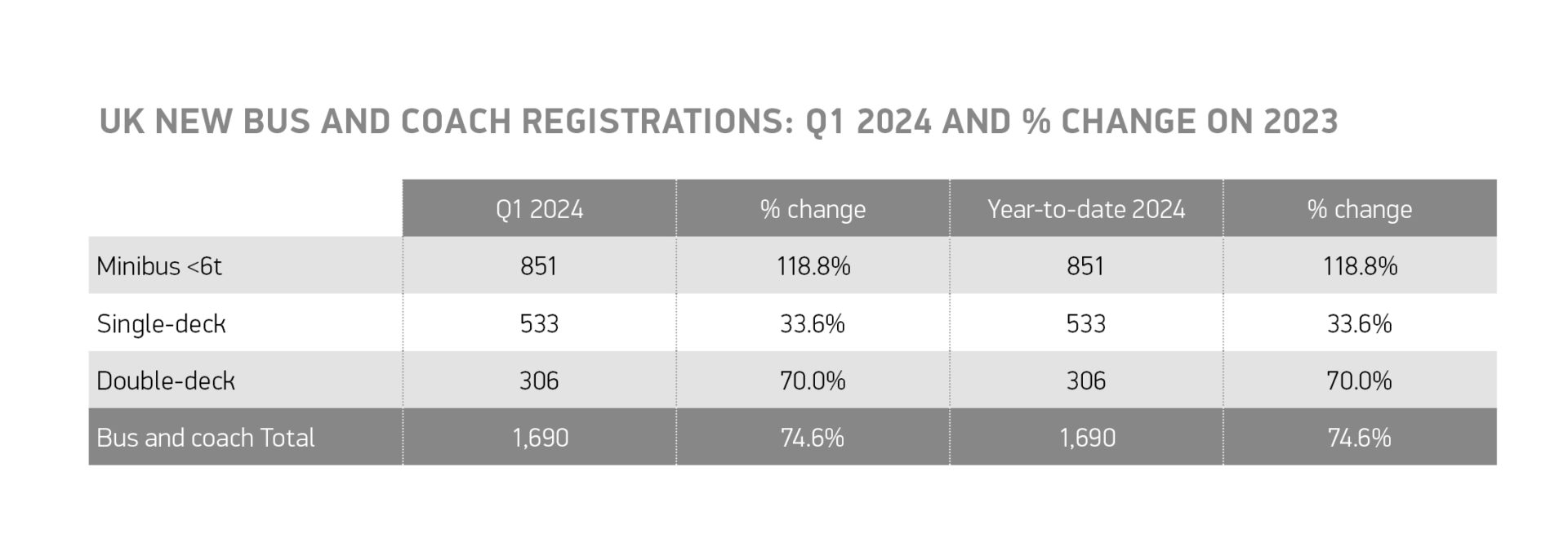

The UK’s new bus, coach and minibus market grew by 74.6% in the first three months of 2024 with 1,690 new PSVs hitting the roads, according to figures published today (16 May 2024) by the Society of Motor Manufacturers and Traders (SMMT).

Growth was driven by a more than doubling in demand for new minibuses, up 118.8% to 851 units. Fleet investment in the latest single- and double-decker buses grew by 33.6% and 70.% to 533 units and 306 units respectively, as operators responded to increasing passenger numbers, which the SMMT claims is helped by measures such as the Bus Fare Cap Grant.

SMMT figures show 322 zero-emission models joined the roads during the period, up 22.9% on quarter one last year. The SMMT says the timely roll-out of the next round of Zero Emission Bus Regional Area (ZEBRA) funding is crucial so that all UK regions can benefit from these vehicles.

Minibuses, meanwhile, remain the biggest overall segment of the market but face special challenges in moving to zero-emission operations, the SMMT says. A major barrier to earlier adoption is licensing restrictions that prevent standard driving licence holders from driving a minibus that weighs more than 4.25 tonnes, which the Society says puts many zero-emission models out of reach for operators. A sensible regulatory derogation to remove this barrier is set to come into effect but not until 2025. According to the SMMT, bringing the date forward to 2024 would give operators the go-ahead they need to invest today.

Mike Hawes, SMMT Chief Executive, said: “Britain’s road passenger transport sector is continuing its recovery amid rising ridership levels and growing operator confidence. The UK has been particularly successful at decarbonising the new bus market, however, that green growth must extend to all sectors, in particular minibuses. Operators are ready to switch to greener mobility but timely action is essential to make sure the journey to net zero includes everyone.”

Q1 registrations by marque

| Marque | Q1 | % Market Share | Q1 LY | % Market Share | % Change |

| FORD | 294 | 17.1% | 45 | 4.5% | 553.3% |

| MERCEDES | 266 | 15.4% | 311 | 31.3% | -14.5% |

| ALEXANDER DENNIS | 240 | 13.9% | 54 | 5.4% | 344.4% |

| WRIGHTBUS | 221 | 12.8% | 60 | 6.0% | 268.3% |

| PEUGEOT | 184 | 10.7% | 29 | 2.9% | 534.5% |

| VOLVO | 91 | 5.3% | 84 | 8.4% | 8.3% |

| VAUXHALL | 86 | 5.0% | 32 | 3.2% | 168.8% |

| BYD | 63 | 3.7% | 144 | 14.5% | -56.3% |

| SCANIA | 62 | 3.6% | 43 | 4.3% | 44.2% |

| YUTONG | 52 | 3.0% | 103 | 10.4% | -49.5% |

| CITROEN | 38 | 2.2% | 15 | 1.5% | 153.3% |

| IRIZAR | 25 | 1.5% | 15 | 1.5% | 66.7% |

| NEOPLAN | 25 | 1.5% | 7 | 0.7% | 257.1% |

| FIAT | 23 | 1.3% | 13 | 1.3% | 76.9% |

| MAN | 10 | 0.6% | 1 | 0.1% | 900.0% |

| RENAULT | 7 | 0.4% | 3 | 0.3% | 133.3% |

| MAXUS | 3 | 0.2% | 0 | 0.0% | #DIV/0! |

| SWITCH MOBILITY | 0 | 0.0% | 1 | 0.1% | -100.0% |

| VAN HOOL | 0 | 0.0% | 2 | 0.2% | -100.0% |

| VDL BUS | 0 | 0.0% | 6 | 0.6% | -100.0% |

| VOLKSWAGEN | 0 | 0.0% | 0 | 0.0% | #DIV/0! |

| CAETANO | 0 | 0.0% | 0 | 0.0% | #DIV/0! |

| SETRA | 0 | 0.0% | 0 | 0.0% | #DIV/0! |

| IVECO | 0 | 0.0% | 0 | 0.0% | #DIV/0! |

| RENAULT TRUCKS | 0 | 0.0% | 0 | 0.0% | #DIV/0! |

| 1690 | 98.1% | 968 | 97.3% | 74.6% |